Lieferungen erreichten 320.000 Einheiten, ein Anstieg von 91 % gegenüber dem Vorjahr, und lieferten einen Gewinn von 4,60 Dollar pro Aktie auf verwässerter Basis sowie einen Umsatz von rund 8,9 Milliarden Dollar für den Zeitraum.

Die Steigerung der Produktionskapazität wurde angetrieben durch Ingenieure wer die Durchlaufzeiten verkürzt hat, wodurch schnelle Lieferungen ermöglicht wurden. Wetten Eine breitere Preisgestaltung trug zu den Bruttomargen bei, wobei sowohl preisgünstige Varianten zusätzlich zu den Standardmodellen beitrugen.

Starship-Style Automation, reduzierte Verschiebungen min. und steigerte die ausgehenden Lieferungen, wodurch der Cashflow an die Produktteams zurückgegeben wurde. fully Integrierte Analysen hoben zudem die Rentabilität in den verschiedenen Regionen hervor, selbst als sich die Makrobedingungen in einigen Märkten abschwächten; also Konkurrenten waren mit Preisdruck konfrontiert.

Verglichen mit e-tron Kollegen, diese Aufstellung bleibt preislich wettbewerbsfähig, verkaufen Die Dynamik bleibt robust, die Auftragseingänge steigen, min. auf die Auslieferung, die in Schlüsselregionen reduziert wurde, Dollar gesicherte Unterstützung, dauerhafte Nachfrage.

Analysten vorschlagen vierteljährliche Lieferungen im Verhältnis zum Preis-Mix verfolgen, um Margen zu lesen; copy Bewährte Praktiken von hochgefahren Regionen, um Renditen zu steigern.

angekündigt Kapazitätserweiterungen sollten die Auslieferungen in die Höhe treiben; heres eine praktische Checkliste: überwachen min. pro Zyklus, ausgehende Sendungen und Dollar des Verdienstes; auch copy regionenübergreifende Benchmarks zur Validierung des Fortschritts, unterstützt durch vollständig finanzierte Lieferketten.

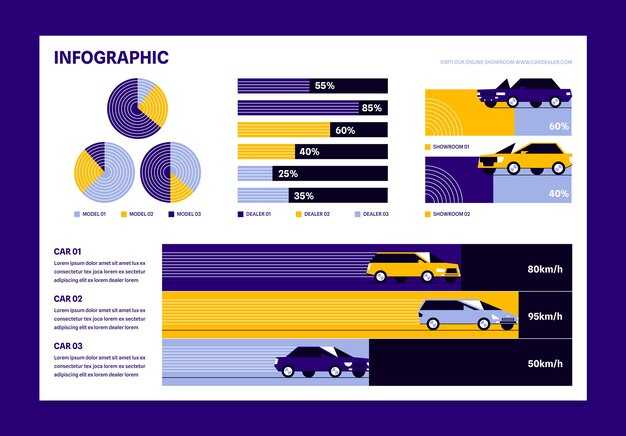

Neueste Metriken und praktische Messwerte

Recommendation: Starte ein fokussiertes, wöchentliches Dashboard, das die operative Marge der letzten Woche, die Investitionsgeschwindigkeit und den Kundenauftragsbestand verfolgt, und allokiere dann Ressourcen über einen einzigen Projektsprint, um den Durchsatz zu verbessern.

Letzte Woche zeigten Auswertungen einen steigenden operativen Leverage, trotz der im April beeinträchtigten Lieferkette; Marge 12,41 %, Stückkosten gesunken um 6,51 % und verlängerte Zahlungsbedingungen für Kunden verbessern den Einzug.

Im April lag die europäische Nachfrage an zweiter Stelle nach Asien, wobei Kunden in politisch riskanten Märkten angesichts der sich verändernden Situation nach billigeren Optionen suchten.

Um die Dynamik ohne Hindernisse aufrechtzuerhalten, implementieren Sie eine leistungsbezogene Vergütung, verschärfen Sie die Kostenkontrolle und vereinbaren Sie eine aggressive Kreditlinie mit Partnern.

Wir haben ein Juniper-basiertes Softwaremodul auf den Markt gebracht, das Produktionsmeilensteine markiert, wodurch Effizienzsteigerungen in Echtzeit erfasst werden können und Kunden mit transparenten Statusupdates unterstützt werden.

Die Rangfolge der Leistung platziert europäische Teams in der obersten Liga; die Betriebsdaten dieser Woche zeigen, dass die Teams in der Lage sind, mit günstigeren Lieferantenrouten zu skalieren und die Stückkosten zu senken, ohne die Zuverlässigkeit zu beeinträchtigen.

heres ein konkreter Plan: Jedem Messwert einen einzelnen Verantwortlichen zuordnen, anreizbasierte Vergütungen festlegen und wöchentliche Auswertungen für Kunden und Investoren veröffentlichen.

Neueste globale Produktion nach Quartal und Modellmix

Dezemberplan: Batterieleistung in kalifornischen Fabriken aufrechterhalten, Auslieferung von Model 3 und Model Y, Ausgleich der Mengen über alle Speicherprodukte hinweg und Sicherung der verfügbaren Kapazität für schnelle Abläufe.

Q4 2024 zeigt Model 3/Y 62% an verkauften Stückzahlen, Model S/X 38%. reuters bemerkte einen letzten Anstieg der Lieferungen inmitten hoher Nachfrage. Speicherprodukte machten 20% an Kapazität aus und trugen dazu bei, die Erträge über die Regionen hinweg auszugleichen.

Die kalifornische Fabrikaktivität blieb aktiv, mit einem schnellen Vorstoß zur Erweiterung von Batterie- und Speicherlinien. Die verfügbare Kapazität stieg, da ausgehende Bestellungen mit den Zeitplänen staatlicher Projekte übereinstimmten; Diesel-Backup-Optionen verlagerten sich in Richtung umweltfreundlicher Einsätze.

Analystennotizen sehen eine Ergebnisdynamik, die eine Expansion an wichtigen Fabrikstandorten unterstützt, wobei die abgesetzten Mengen eine starke Nachfrage über alle Produkte hinweg widerspiegeln. Die Kennzahlen für Dezember unterstützen weitere Kapazitätserweiterungen in Schlüsselmärkten.

Ausblick: Reuters-Berichterstattung und Regierungsprojekte deuten auf eine rasche, nachhaltige Expansion hin; ein gewaltiges Auftragsbuchwachstum signalisiert die Übereinstimmung mit den Erwartungen hinsichtlich des Modellmixes. Vollständig aus Erträgen finanziert, mit laufenden Lieferungen von Produkten in allen aktiven Märkten.

Tesla: Auslieferungsvolumen vs. Produktionsdurchsatz

Empfehlung: Monatliche Liefermengen an Produktionsdurchsätze anpassen, indem Linienwechsel geglättet werden; dies reduziert Kosten und verbessert die Vorhersagbarkeit für die Konsummärkte. Über die Monate hinweg bleibt die Abstimmung entscheidend; diese Anpassungen dienen als Kerndisziplin für die Einsatzteams.

Die Dezemberplanung verankert viermonatige Ziele und eine vierteljährliche Kadenz; Ingenieure passen Linien in Shanghai und Texas basierend auf Marktsignalen an.

Die Geschichte aus der letzten Periode zeigt, dass sich diese Lücken zwischen Lieferungen und Durchsatzen vergrößern; in Monaten, in denen der Schwung weltweit nachließ, zogen die Märkte an.

Zwischen den Betrieben in Shanghai und Texas gab es eine Abweichung beim Durchsatz: Shanghai erholte sich nach den angekündigten Kapazitätserweiterungen, während Texas mit saisonaler Schwäche zu kämpfen hatte und den Dezember mit geringeren Liefermengen beendete, da die globale Nachfrage rückläufig war.

Eine tiefere Analyse hebt vier Hebel hervor: Modellmix, Lieferanten-Kadenz, Schichtplanung und Kosten.

Um dies zu beheben, müssen die Ingenieure die Leitungsraten an Standorten mit verzögerten Lieferungen anpassen, Anlagen nach Möglichkeit umverteilen und den Inventarfluss straffen. Hier hilft ein vierwöchiger Rhythmus, Anzeichen von Abweichungen zu erkennen. Die Überprüfung im Dezember wird die Anpassungen steuern.

Die Ansicht des Unternehmens betont, dass die zuletzt angekündigten Expansionen zu einer stärkeren Übereinstimmung zwischen dem erwarteten Durchsatz und den beobachteten Lieferungen führen sollten.

Vier Maßnahmen, um jetzt zu beginnen: Optimierung von vier Modellvarianten für den Markt-Mix, Beschleunigung der Upgrades der Linien in Shanghai und Texas, Implementierung monatlicher Dashboards und Bericht der Ergebnisse vom Dezember in einer prägnanten Darstellung.

Abschließende Anmerkung: Diese Schritte sollten die Kosten senken, das Vertrauen der Verbraucher stärken und das weltweite Wachstum trotz monatelanger Volatilität unterstützen.

Regionale Umsatzaufschlüsselung: USA, China, Europa & Andere Märkte

Zielmargenexpansion in Regionen mit hoher Rendite durch Umschichtung von Investitionen hin zu margenstärkeren Fahrzeugen und Batteriekonfigurationen.

In den USA und Europa bleibt die ausgewiesene Rentabilität pro Fahrzeug solide, während chinesische Kunden sich hin zu preisgünstigeren Modellreihen verlagern. Die Marktbeobachtung nimmt zu, da Investoren Marken über Generationen hinweg vergleichen, während das Management Margen und offene Preisgestaltungsstrategien betont.

Chartdaten zeigen Margenunterschiede zwischen Regionen, mit einem Anstieg der Nachfrage nach batteriezentrierten Modellen und Pannenhilfe-Paketen, die die Kundenbindung erhöhen. Musks Kommentare zu Batterietechnik und Cybertruck prägen die Erwartungen der Investoren und treiben die Nachfrage an, selbst wenn makroökonomische Gegenwinde bestehen.

Zusammen laufen ihre Investitionen auf Milliarden, die offene Ladenetzwerke und Batteriezellprogramme in chinesischen und europäischen Betrieben untermauern. Diese Dollars befeuern die Expansion von Marken und Straßendienstleistungen und stärken die Kundenbindung.

| Region | Umsatzbeteiligung (%) | Gemeldete Marge (%) | Fahrzeuge (Generation) | Kunden (Millionen) |

|---|---|---|---|---|

| UNS | 42 | 18 | 3.2 | 3.0 |

| China | 28 | 16 | 3.8 | 3.5 |

| Europa | 20 | 17 | 2.9 | 2.1 |

| Andere Märkte | 10 | 14 | 1.6 | 1.5 |

Jährliche und vierteljährliche Wachstumsraten: J/J und Q/Q

Vergleichen Sie die Dynamik im Jahresvergleich mit den Veränderungen im Quartalsvergleich, um die Geschäftsplanung zu steuern.

Nutzen Sie eine Zwischenablage-fähige Tabelle, um Metriken nach Einzelposten zu erfassen, einschliesslich YoY-, QoQ- und Zwischenquartalsveränderungen.

Hier ist ein prägnanter Überblick darüber, wie man Ergebnisse in Handlungen umsetzt, indem man praktische Datenmanagement-Praktiken und funktionsübergreifende Beiträge nutzt.

- YoY-Momentum nach Regionen: Shanghai +121 %, andere Gebiete +61 %, YoY über alle Märkte hinweg ca. +81 %.

- Quartalsweise Veränderungen im März: März +31 %, Juni +51 %, angetrieben durch taktische Werbeaktionen und Produktionsanpassungen.

- bevphev mix: Der bevphev-Beitrag stieg im Vergleich zum Vorquartal um vier Prozentpunkte, wodurch der bevphev-Anteil zwischen 40 % und 44 % der Produktion lag.

- Wettbewerbsvergleich: Der Ioniq bleibt ein Bezugspunkt für die Verbraucherakzeptanz in kompakten EV-Segmenten, was Warrenai Research als Widerstandsfähigkeit in den Lieferketten hervorhebt.

- Verbrauchernachfrage: Die Verbrauchernachfrage blieb in vielen Regionen robust; der Auftragsbestand wuchs unterhalb einiger Prognosen, während die Auslieferungen fortgesetzt wurden.

- Ergänzung zum Sheet: Neue Spalten erfassen bevphev, Shanghai Line Performance und Consumer Delivery Checkpoints.

- politische Risikofaktoren: Politischer Gegenwind beeinträchtigte einige grenzüberschreitende Sendungen; obwohl Anpassungen die Wiederaufnahme der Sendungen ermöglichten, bleibt das Risiko bestehen.

- Erfolge: Zu den wichtigsten Erfolgen zählen der Ausbau der Anlagen in Shanghai und Partnerschaften, die zu Verbesserungen der Impact Scores geführt haben.

- Aus diesen Erkenntnissen: Lagerbestände zwischen Regionen abstimmen, Linienkapazität anpassen und Verbesserungen des BEV/PHEV-Mixes anstreben.

shanghai

Kürzlich lieferten die Teams in Shanghai Linienerweiterungen, die das Wachstum von BEV/PHEV und die Akzeptanz durch die Verbraucher unterstützen.

Fazit: Richten Sie die Maßnahmen an den YoY- und QoQ-Signalen aus, um das Wachstum zwischen März und Juni aufrechtzuerhalten, wobei der Fokus auf der Umsetzung in Shanghai und den BEVPHEV-Zielen liegt.

Auswirkungen auf Werksebene: Fremont, Shanghai, Berlin & Texas auf die Produktion

Empfehlung: Kapazitätssteigerungen in Fremont, Shanghai, Berlin, Texas durch gestaffelte Hochläufe angleichen, um Rentabilität bei gleichbleibender Qualität zu erzielen. Kernarbeitsabläufe priorisieren, Liniengeschwindigkeit optimieren und Zyklen von Bestellung bis Lieferung für Kunden verkürzen.

Fakt: Das Fremont-Werk ist riesig und vollständig integriert und produziert eine Bestseller-Modellreihe. Die Produktion liegt bei rund 480.000 Einheiten pro Jahr, wobei die im letzten Jahr eingeführten Kapazitätserhöhungen die Kapazität für Frontend-Guss und Lackierung erweitern. Der Modellmix konzentriert sich auf Model 3 und Model Y und unterstützt die Rentabilität bei gleichzeitiger Senkung der Servicekosten. Kunden verlassen sich auf den Online-Konfigurator, um sich frühe Lieferzeiten zu sichern.

Das Werk in Shanghai treibt die enorme internationale Nachfrage an und produziert ein hohes Produktionsvolumen. Kapazitätserweiterungen wurden eingeführt, um Aufträge in Europa und Asien zu bedienen. Online-Bestellungen sind weiterhin stark; politische Erwägungen beeinflussen die Zeitplanung und den Zugang zu Lieferanten. Laut den Plänen der Lieferanten treiben Automatisierungs-Upgrades den Durchsatz voran und verbessern die Rentabilität in allen Märkten. Einige Komponenten werden über die Nevada-Module-Pipeline bezogen, um die werksübergreifende Integration zu rationalisieren.

Der Berliner Standort unterstützt den europäischen Betrieb und produziert solide mittlere Volumina für benachbarte Märkte. Politische und regulatorische Zyklen erfordern flexible Personalplanung und Lieferanten-Diversifizierung. Geplant ist die Umstellung der Fertigungslinien auf Batteriemodule, um die Auswahl an Reichweiten für Bestseller-Produkte zu erweitern. Ihre grenzüberschreitenden Lieferungen sind auf eine robuste Logistik in den EU-Korridoren angewiesen.

Der Standort in Texas demonstriert eine vollständig integrierte, funktionierende Massenproduktion von Trucks und Crossover-Varianten mit schnellen Durchlaufzeiten. Geplant ist die Erweiterung der Bereiche Stanzen, Lackieren und Batteriemontage, um die Produktion für die US-Märkte zu steigern. Starship-Programmteams koordinieren sich mit Automobilprogrammen und tauschen Lean-Methoden an vier Standorten aus. Der finanzielle Ausblick verbessert sich weiterhin, da sich die Rentabilitätssteigerungen über regionale Lieferketten hinweg verstärken, während Kunden von schnelleren Online-Bestellungen und einem breiteren Zugang zu Superchargern profitieren.

Fazit: Werksübergreifende Koordination fördert die Resilienz in Fremont, Shanghai, Berlin, Texas. Die Geschichte des Hochfahrens an vier Standorten beweist, dass Erfolge durch disziplinierte Ausführung erzielt werden, während Ihre Projekt-Roadmap mit den Anforderungen der Modellpalette und den Plänen zur Erweiterung der Online-Bestellung, des Zugangs zu Ladestationen und der vollständig integrierten Logistik übereinstimmt. Laut Finanzprüfungen wächst die Rentabilität, und ihre Teams liefern trotz politischer Veränderungen, Nevada-Modulflüssen und Erkenntnissen aus dem Starship-Programm eine konsistente Leistung. Ist dieser Ansatz für Ihre langfristige Strategie von Bedeutung? Ja, das ist er.

Tesla Statistics, Data & Sales Numbers – All the Latest Figures">

Tesla Statistics, Data & Sales Numbers – All the Latest Figures">