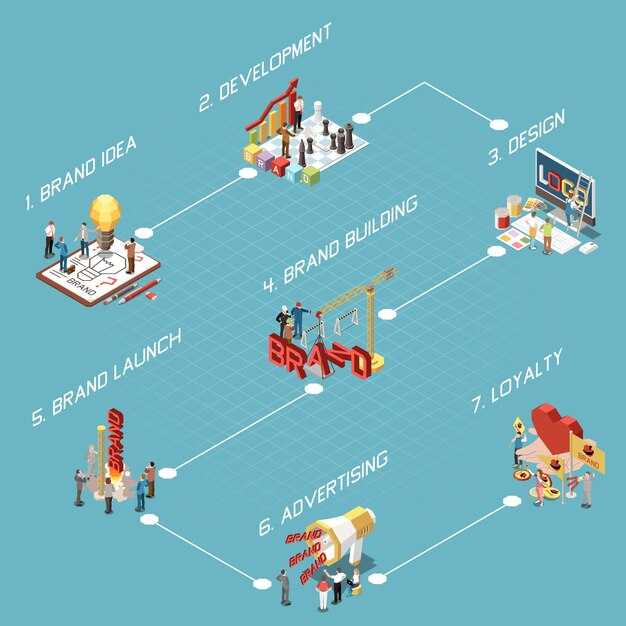

Start with a precise customer problem and validate your offering with a rapid prototype within two weeks. This approach yields early feedback and keeps the team tight around a 유일한 value proposition. Align sustainability 그리고 financial criteria from day one to ensure the product could stay viable as it scales.

Stage 1: Discovery and prioritization identify user pains and map the market. Interview many potential users, quantify the business impact, and anchor decisions to a short list of features that justify the first release. Tie every finding to brand value and a preliminary distribution plan so you can test reach as you learn.

Stage 2: Scoping defines the minimal viable offering and validates market fit. Craft a clear hypothesis, estimate the financial impact, and identify niche segments where you could outperform incumbents. This stage aligns resources and gives you a realistic timeline for forming a cross-functional team that handles design, engineering, and operations.

Stage 3: Concept and design translates insights into a concrete concept and a visual/interaction design that communicates the brand promise. Create a small set of concepts, then pick the 유일한 one to prototype. Emphasize what makes the offering easy to adopt, and plan a distribution path that reaches customers where they are.

Stage 4 & Stage 5: Development and Testing build the chosen prototype with a lean architecture. Set two-week sprints, keep many checkpoints, and reserve 15–20% of the budget for risk and iteration. The team could adjust scope if technical risk rises, and staying focused on sustainability helps ensure long-term viability. Stage 5 tests functionality with real users, captures metrics, including performing features, and surfaces edge cases to inform the backlog and distribution plan.

Stage 6: Launch introduces the product to a controlled audience, measures adoption, and learns from real usage. Shorten onboarding, simplify the first run, and track sustainability metrics like churn and cost of acquisition. A strong brand message and a clear distribution plan help you gain traction quickly.

Stage 7: Learn and prioritize aggregates data across cohorts, informs feature prioritization, and feeds the next cycle. Use prioritization methods to decide what to extend, what to retire, and where to invest next. This loop gives you a path to innovate 그리고 sustainability while expanding your niche and adding value to your 제공하다, enabling further growth.

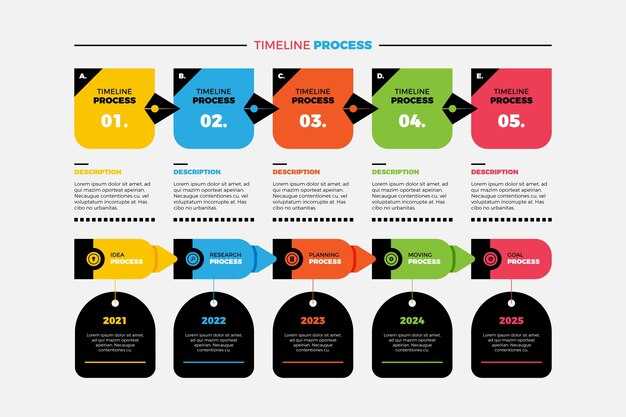

Seven-Stage Framework for New-to-the-Firm Products

Start with a seven-stage framework and assign owners to each phase to accelerate time-to-value for new-to-the-firm products.

-

Discovery & Opportunity

Objective: uncover problems across their segments. Duration: 2-4 weeks. Activities: 12-16 customer interviews, 4-6 internal workshops, mapping user jobs, and generating hypotheses. Outputs: problem statements, 3 prioritized segments, initial success metrics. Events: discovery review with a cross-functional member team. Gate: go/no-go to Scoping. Since this stage relies on customer input, youll run 2-3 interviews per segment and capture generated data to guide the next phase. This article regarding practical steps helps reveal where value lies and sets the foundation for the rest of the process.

-

Scoping & Validation

Objective: define boundaries, align on value, and set the business case. Duration: 1-3 weeks. Activities: refine features, create low-fidelity designs, and validate willingness-to-pay with 8-12 quick interviews. Outputs: product brief, feature backlog, risk log, and go-to-market assumptions. Events: scoping checkpoint with established stakeholders. Gate: choose the top 5 features to carry forward; never overcommit without validation. Leverage findings from Discovery to guide decisions and ensure the team is coordinating around a single plan.

-

Business Case & Validation

Objective: quantify ROI and costs. Duration: 2-4 weeks. Activities: build a formal business case, model TCO and price tiers, generate a 12-month forecast, and test price sensitivity with 15 customer interviews. Outputs: final ROI model, pricing strategy, go-to-market plan. Events: leadership review of the business case. Gate: final sign-off to proceed to Design if the ROI rationale is solid. This phase establishes credibility with stakeholders and provides a clear base for the next steps.

-

Concept Design

Objective: translate validated problems into the product concept and UX. Duration: 3-6 weeks. Activities: create a UX map, high-level architecture, and a test plan; run 6-8 concept interviews with users to reveal acceptance. Outputs: concept specs, prototyping plan, risk register. Events: design review with core team members. Gate: acceptance criteria met by at least 70% in concept tests; proceed to Prototyping.

-

Prototyping & Development

Objective: build the first working version. Duration: 6-12 weeks. Activities: rapid prototyping, iterative sprints, internal demos; cross-functional people from product, engineering, design, and operations; mid-way reviews. Outputs: functional prototype, technical architecture, production readiness plan. Events: internal demo with stakeholders. Gate: critical performance tests pass; move to Pilot when the prototype demonstrates viable user value and feasible execution plan. This phase comes with tight feedback loops that keep the team running on schedule.

-

Validation & Pilot

Objective: validate in real use and refine. Duration: 4-8 weeks. Activities: field pilots with 2-4 key customers, structured events, data collection, and feature adjustments. Outputs: pilot report, validated metrics, revised backlog. Events: pilot review with customer and internal teams. Gate: pilot success criteria met; finalize the GTM plan and prepare for launch. The evidence provided by pilots helps the team adjust before broader rollout.

-

Launch & Scale

Objective: launch with disciplined execution and monitor ongoing performance. Duration: 2-4 weeks for launch; then ongoing. Activities: publish final product, train support, initiate demand generation, monitor KPIs, and schedule bi-weekly reviews for the first quarter. Outputs: final release, onboarding materials, established KPIs, ongoing improvement plan. Events: launch event and post-launch review. Gate: leadership sign-off; product enters steady running with a defined maintenance cadence. This final phase delivers value to customers and confirms the product has a clear path to scale.

Define the Problem and Desired Outcomes

Draft a concise problem statement that captures the core issue and the desired outcomes. Capture input from stakeholders and user preferences to create a single source of truth you can reference throughout the process. When necessary, validate the problem with targeted research to verify that the issue is real and worth solving.

Define the problem by interviewing users and stakeholders alongside data from targeted research. Segment the audience into core groups and capture each group’s pain points, preferences, and success criteria. Develop a rough map of the gaps that the product must close, and document how each gap affects outcomes.

Define the desired outcomes for each segment and align them with business goals. Specify targeted, specific metrics to receive clear alignment across teams. Set rough targets for each metric to guide decision-making, and write a brief description of success for each segment to keep plans focused alongside product constraints.

With the problem statement in hand, youll draft a lightweight plan that outlines steps, owners, and timelines. Youve mapped the core tasks and identified when to collect additional data, ensuring alignment before moving to ideation. Alongside this, capture constraints and resources necessary to reach the targeted outcomes. Include a bite of the draft plan as a quick reference for leadership.

Use focused research methods: quick surveys, interviews, and usage data to validate the problem. Capture quantitative signals and qualitative insights in a single document so the team can reference it during design and evaluation. A synthesis explains the link between user pain and business impact, guiding prioritization and trade-offs. Many teams use these inputs to set clear priorities across functions.

Evaluate Market Need and Internal Demand

Start with a focused screening to validate the actual need among target users and internal teams before drafting concepts. Gather evidence, define a concrete problem statement, confirm interested stakeholders, and set a clear threshold for internal readiness. This upfront step prevents wasted effort later.

Gather evidence from three sources: customers, brands you admire, and internal resources and teams to surface early concepts. Conduct short interviews, quick surveys, and lightweight field tests to quantify pain points and willingness to adopt a solution. Use a paper-based scoring rubric to translate qualitative signals into a simple, actionable score that guides prioritization.

Assess market fit with a modern, data-informed view: estimate the size of the need, forecast future growth, and map how a new offering could capture share. Align technology options with your differentiation and ensure your core expertise supports the approach. Build a realistic planning timeline that ties milestones to available resources.

Run three quick tests: problem validation (do people actually need a solution?), concept screening (are our concepts compelling to early adopters?), and internal demand check (can we mobilize the team and budget?). Let results drive a go/no-go decision and highlight the concept with the strongest business case.

Draft a concise concept paper that captures the need, the proposed solution, differentiation, required resources, and the timeline. Share it with key brands, partners, and internal teams to secure alignment and speed up execution.

From there, create a focused development plan: assign owners by area of expertise, specify milestones, and face constraints while locking the timeline. Track early indicators of interest, adjust the approach as needed, and preserve resources while pursuing sustainable growth.

Prototype Quickly and Validate with Internal Users

Run a 72-hour rapid prototype sprint with internal users to validate core flows and confirm two critical goals. Build a high-quality, clickable prototype that mirrors real-world tasks; avoid overpolishing. This lets you observe where users stumble and what they value, so you can adjust before committing development effort.

Steps to execute: define measurable goals (task completion rate, time to task, error rate) and a clear success threshold; recruit internal users from diverse roles (sales, support, finance) to reduce bias; recruit others when needed; lean on expertise during discovery to surface assumptions and capture input.

Prototype design specifics: keep 3-6 screens, use realistic data in a marketplace-like flow, and simulate real interactions. Emphasize creative but practical design, with a clear path to a decision point, so internal users can validate whether the concept meets the goals.

Validation and learning: collect input and qualitative feedback alongside metrics to support further decisions; provide concrete, actionable recommendations for the next iteration; communicate outcomes to product, engineering, and design teams; maintain a prioritized backlog and a plan for the next iteration.

Cadence and expansion: expanding internal testing to additional teams guards against siloed feedback; plan a year of internal validation and then scale to more groups; use the insights to refine the product to better align with customers and marketplace needs.

Cost, timing, and throughput: budget a small, repeatable process–2-3 hours per participant, with 20-30 internal users in a cycle; keep the setup lightweight to maintain velocity; this approach ensures expertise is leveraged and the process remains sustainable year after year.

Set Stage-Gate Criteria and Go/No-Go Triggers

Define formal stage-gate criteria and Go/No-Go triggers to move ahead only when thresholds are met. Assign a dedicated gate owner and use a concise, auditable decision template to preserve stability as teams are evolving.

Frame the evaluation around four factors: growth and customer value, technical feasibility, financial viability, and operational readiness. For each gate, specify what counts as success, which channels will validate the concept, and how many uncertainty points are tolerable. Maintain clear communication so teams understand the point at which a pivot is needed.

Gate 1 begins with a clear problem statement and a proposed solution. Criteria: 30 customer interviews, value proposition score >= 7/10, a high-quality prototype demonstrated in a controlled lab, a two-channel validation plan, and a growth forecast showing potential > $5M annual revenue. If these targets aren’t met, pause and rework the concept with updated inputs.

Gate 2 requires technical feasibility and early design stability. Criteria: TRL 4–5, technical risk score <= 2 on a 1–5 scale, test results within ±10% of spec, a validated manufacturing concept with cost estimates within 15% of target, and a risk mitigation plan addressing the top three uncertainties. Document a 90-day plan to resolve the gaps.

Go/No-Go triggers are binary: a Go if two of three dimensions show green signals (market, tech, financial) and no critical risk dominates; a No-Go if any single gate reveals unsustainable cost, unmitigated risk, or insufficient customer validation. If neither path is clear, extend review by 15 days with targeted experiments and updated metrics.

Communication and governance ensure everyone stays aligned. Use formal reviews, a single host for updates, and channels that collect feedback from UX, engineering, manufacturing, and sales. theres a dedicated point of contact inside each function, and a frustrations log captures blockers and lessons learned to improve the next iteration.

Plan Internal Alignment and Resource Allocation for Launch

Begins with a 90-day plan that assigns ownership, forecasted budgets, and milestones for each function, and locks this into one alignment document they can download. Creating a simple, guided dashboard helps visualize headcount range, spend, and timelines, so leadership critically sees the trajectory.

To ensure realism, conduct interviews with stakeholders across product, marketing, sales, and operations to capture constraints and expectations. The interviews generated a list of necessary points and trade-offs, which becomes the foundation for a shared language they can use to guide decisions and planning.

Map the range of resources: people, tools, and external partners, plus time buffers. Create a catalog of positions and skills, with owners and verified capacity. Following this, align schedules with prototypes: allocate time for 2-3 prototypes and guided testing; plan user feedback sprints.

Benchmark against competitors to set realistic ramp assumptions, and note the chance of bottlenecks in manufacturing, logistics, or distribution. Use the download link for the alignment guide and keep it free for involved teams.

Governance and change control: define decision rights, approval windows, and how to adjust scope without derailing the plan. Offering a concise guide for triggering reallocations and documenting changes; this helps keep the effort transparent.

Close with a practical checklist of must-dos: alignment sign-off, resource ledger, prototype schedule, and risk buffers. The plan offers clear points for the following review cycle and a route to prevent fake forecasts from skewing decisions.

Product Development Process – The Seven Stages Explained">

Product Development Process – The Seven Stages Explained">