Start with a concrete recommendation: use data to define your targeted segments and build a workable plan that serves as a guide for resources. This lets you move beyond guesswork and tick off the first milestones, accelerating learning.

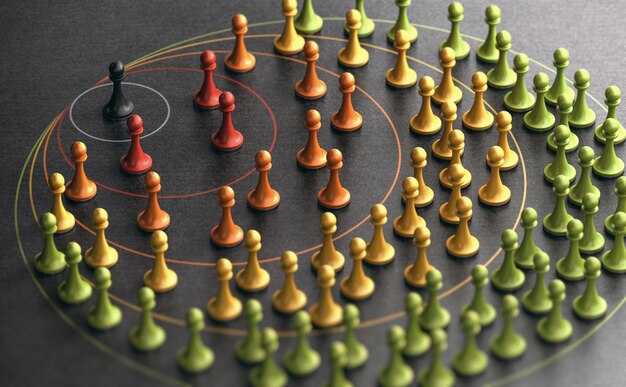

Market segmentation is the process of grouping people by shared preferences 그리고 구매 behavior, so teams can tailor services 그리고 제공합니다 to their needs.

There are several segmentation types: demographic, geographic, psychographic, 그리고 behavioral groups. Each type reveals different needs and creates powerful opportunities to tailor your approach.

Implementation guide: start by collecting data from CRM systems, web analytics, and surveys; test segments with small campaigns; measure results against clear metrics; and refine your 제공합니다 based on learning, and use findings to 강조 gaps in your data.

Practical example: a services provider segments their audience by industry and company size, then shifts marketing toward two targeted groups. The team tunes the 제공하다 to align with their purchasing windows, which informs next steps and supports learning.

Definition: what segmentation means in practice for campaigns

Start with a concrete recommendation: define 3-5 core segments based on needs, behavior, and value potential, then design paired messages and offers for each. Use a clear structure: segment name, demographic and psychographic traits, buying triggers, and preferred channels. This keeps targeting precise and, as youve learned, helps communicate clearly across touchpoints and within the environment because understanding each segment’s core drivers improves campaign outcomes. This being true, it also supports better design and planning.

Map resources and plans: allocate resources to produce tailored content, without overloading teams or duplicating work. Use a longer horizon for production, 2-4 weeks per cycle, and set a tight review process to avoid drift, helping teams stay aligned. Link each asset to a segment’s plan so every release can satisfy a defined purpose.

Splitting the audience by behavior, occasion, and value yields more relevance than generic messages. For each segment, produce a concise set of messages that reflect real use cases, with a luxury option for high-value customers. Treat this as a game of being precise: generate 2-3 variants per segment and test them in the same environment to see what resonates.

실용적인 단계

Audit data sources and identify top signals: purchase history, site behavior, and engagement. Define 3-5 segments with clear traits and goals. Design targeting and messages per segment, and map assets to each plan. Create a one-page brief for teams to align production, budgets, and plans. Run a pilot for 2-4 weeks and iterate based on results.

Messaging and resources

Develop templates that reflect each segment’s voice while keeping brand consistency. Use lightweight, modular assets to shorten production cycles and reduce longer resource demands. For luxury segments, emphasize exclusivity and personalized service. Provide guidance on cross-channel communication: email, social, site, and paid media. Monitor results and refine segmentation practices accordingly.

Common segmentation bases: demographic, geographic, psychographic, and behavioral

Begin with demographic data to map core groups; above all, layer psychographic and behavioral signals to resonate with that audience and serving tailored offers that increase loyalty and revenue.

Demographic and Geographic bases

- Demographic: Define segments by age, gender, income, education, family size, and life stage. Source data from internal CRM, loyalty programs, and transactional history; build profiles around who buys, when, and how often. Action: create 4–6 age bands and monitor willingness to pay; align pricing or subscription options with affordability for each segment. Some segments show higher response; within these groups, prioritize on value and growth potential relative to cost. Example: a Stella coffee line targets 18–34 with a mid-price plan and simple onboarding to boost sign-ups.

- Geographic: Segment by region, city size, climate, and urban vs rural patterns. Use internal store data, IP geolocation, and regional sales dashboards; adjust assortments and promos by within-region demand. Action: run region-specific offers and schedule deliveries to optimize delivery windows; track regional findings and adjust annually. Demand in some areas can fall in off-peak months, so add seasonal promotions to sustain volume. Example: a bakery network tunes product assortments for coastal vs inland markets to improve serving alignment.

Psychographic and Behavioral bases

- Psychographic: Focus on values, lifestyle, interests, and attitudes. Gather data from surveys, loyalty feedback, and social listening; tailor messages that resonate with how customers view themselves and with the company voice. Action: craft campaigns around sustainability for health-conscious segments or convenience for busy professionals; align tone with the brand and target. Somehow, connect creative with personal values to achieve stronger resonance. Findings from these tests guide annual planning and help you compare segments to Stella’s positioning. Examples: run two ad variants and measure which copy resonates more.

- 행동학적: Track purchase frequency, usage, occasions, and channel preference. Use real-time signals from apps and in-store scans; feed findings into optimization rules and metrics. Action: create tiered offers by loyalty status and usage; trigger prompts earlier in the buying cycle to lift conversion. Example: customers who buy coffee weekly receive a loyalty boost and early access to new blends, increasing spend and loyalty.

Data collection and analysis: turning signals into actionable segments

The answer is to create a unified data layer that merges first-party signals from your website, app, CRM, newsletter, and social platforms into an accessible, in-hand view for fast decisions. Define the attributes and map events to user IDs so teams operate from a single source of truth and a clearly defined brand context.

Capture habits, page interactions, purchase intents, and external signals. However, guard against dilute signals by applying criteria that keep only meaningful attributes and a tight taxonomy, cutting wasted data and avoiding over-broad audience groupings.

Turn raw data into actionable groups using analytical methods: clustering for behavioral similarity, scoring rules for engagement, and funnel analysis for conversion touchpoints. The result is defined segments you can test and optimize over time, looking for enduring patterns, still aligned with real behavior.

Make segments actionable by tying them to audience personas and brand campaigns. Build a shared set of dashboards and content workflows that keep stakeholders in the loop, making decisions faster and ensuring the work remains in-hand and aligned across teams.

Use trendy signals cautiously, not chasing every cue. Validate each segment’s impact on conversion with controlled tests, and keep the audience lean to avoid dilute signals that muddle messaging. Looking for stable habits that persist beyond short-term spikes.

A gale of signals can overwhelm dashboards; implement a staged approach to intake: start with 3-5 defined segments, then expand only after confirming impact. Ensure governance covers data protection, external inputs, and accessibility for teams across platforms.

Publish a concise analytical newsletter to share wins, lessons, and next tests. Track metrics for each segment’s performance, and keep the development loop tight so brand, audience, and channels stay aligned with the defined plan across platforms.

Messaging strategy by segment: tailoring value propositions, tone, and channels

Define segment-specific value propositions for each target group and align tone and channels accordingly.

Use psychographic and behavioral research to identify differences in motives, barriers, and media preferences. Build defined propositions that address specific outcomes–time saved, cost reduction, revenue lift. Keep the core benefit unified across channels while tailoring language to each segment’s minds and decision moments. Use a lightweight collection of data from CRM, surveys, and site analytics to keep profiles accurate and scalable, enabling the company to operate with consistent systems across touchpoints.

theres no room for guesswork – segmentation must be precise. As vimal notes in the analytics playbook, start with a little scoring to rank segments by potential impact and ease of activation; this list helps maintain focus while you scale.

Map tone to motives: concise and practical for efficiency seekers; warm and aspirational for growth-minded buyers; data-informed for technically oriented groups. Ensure messaging remains authentic and supports lasting loyalty by emphasizing tangible gains and credible proof. Essentially, align each segment to a defined customer journey with entry points, mid-course nudges, and clear calls to action.

Channel strategy aligns with where each segment consumes media: tech audiences respond to technical blogs, LinkedIn, and demo videos; younger consumer segments engage on Instagram, YouTube, and TikTok; price-conscious shoppers search and retarget on search and social. Use unified creative assets and standardized formats to maintain a cohesive look and feel across platforms; this reduces friction and accelerates scaling of campaigns. Therefore, tailor content formats and lengths to each platform while preserving a consistent brand voice. Think cricket-like precision when selecting targets to minimize waste and maximize results.

To close, implement a simple measurement cadence: track engagement, clicks, conversions, loyalty signals, and ROI per segment. Define targets, collect data in a shared dashboard, and review weekly with cross-functional teams. A well-defined approach links messaging to business outcomes and keeps systems aligned as you scale.

| 세그먼트 | Defined Value Proposition | Tone | Channels / Platforms | Key Metrics (Results) |

|---|---|---|---|---|

| Tech-savvy urban millennials | Onboard fast with personalized shortcuts that save time and reduce setup effort; demonstrate measurable efficiency gains | Direct, data-driven | LinkedIn, YouTube demos, Instagram, technical blogs | Activation rate, time-to-value, feature usage |

| Small business owners | ROI-focused bundles with clear pricing and quick payback; emphasis on practical outcomes | Practical, respectful | Email, LinkedIn, webinars, Facebook groups | Demo requests, qualified leads, conversion rate |

| Loyal customers | Exclusive perks, early access, and personalized recommendations that amplify continued success | Warm, appreciative | Email, SMS, in-app messages | Retention rate, repeat purchases, loyalty sign-ups |

| Price-sensitive shoppers | Transparent pricing, value bundles, and time-limited offers that improve perceived value | Straightforward | Search ads, Facebook/Instagram, price comparison sites | CTR on price-focused ads, conversion rate, average order value |

Examples in practice: quick B2C and B2B case glimpses

If you wish to validate segmentation quickly, map your user base into 4 addressable targets by buying cues and cultural signals. Use grouping that combines lifestyles with urban contexts. Track the entire path of engagement with explicit metrics: buying categories, time-to-purchase, and response to creative. This approach gives you a clear view of where to invest and which minds to stop chasing; it also helps you avoid missed opportunities by dividing resources among the right targets, from urban to cultural segments.

B2C case glimpse

A consumer app grouped users into four clusters: urban young professionals (18-34), urban families, culture-driven shoppers, and pragmatic bargain hunters. Buying categories favor groceries, personal care, and streaming; urban clusters generate 60% of sessions, while culture-driven shoppers drive higher conversion per impression. The curve of engagement rises after a tailored 2-message sequence, with a 28% uplift in first-month purchases. The internal data feeds reveal implicit signals–wishlist additions, category-page time, and repeat visits–that guided creative tweaks. This stop on broad messaging and the focused addressing of addressable targets reduced waste in media spend by 22% and improved ROAS by 1.8x over three months. A KPI tick on each cluster tracks progress. arent all users the same, so dividing into parts matters. The result gave you a useful path to tailor offers for each lifestyle cluster and to honor the wish of teams aiming for measurable outcomes.

B2B case glimpse

For B2B, map target accounts by industry, company size, and buying committee roles. Build four addressable segments: IT buyers in mid-market, procurement-led teams, R&D stakeholders, and channel partners. Focus on implicit pains–time-to-value, integration ease, and risk reduction–and tailor messages to each segment. The companys sales team targets 200 accounts with a 25% engagement rate and 80 SQLs per quarter; average deal size sits near $40k, and the most valuable deals shorten the path by about 14–21 days. By dividing accounts along function and need, the internal workflow improves remarketing efficiency and reduces wasted touches. After 90 days, win rate rose by about 12% and cost per SQL fell by ~18%. These results come from addressing addressable segments, not chasing generic opportunities, and from using cultural and technical signals to refine content and demonstrations.

What Is Market Segmentation? Definition, Types, and Practical Examples">

What Is Market Segmentation? Definition, Types, and Practical Examples">