Recommendation: deploy AI-powered product recommendations and visual search on your e-commerce site to lift profits in the next quarter. Use signals from emails and on-site behavior to tailor each session, avoiding generic results and friction at checkout. This approach aligns what shoppers see with their interests in real time and sets a clear path for measurement.

Where AI shines, it delivers consistency and high-quality experiences across channels. It standardizes lines of product copy while preserving a unique voice, using creativity to spark interest. The tone remains friendly, while data-backed signals keep copy and visuals aligned with shopper intent.

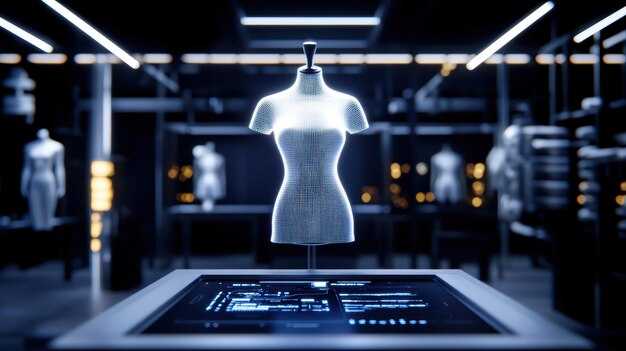

Interactive features–such as virtual try-ons, chat-based styling assistants, and image-based search–empower shoppers to explore outfits without friction. Build a practical playbook for rollout, specify milestones, and define automation checkpoints to keep staying ahead. These elements improve profits and consistency across campaigns, while keeping experiences high-quality.

Further examples span inventory and design: AI forecasts demand to optimize stock lines, supports sustainable material tagging for ethical brands, and accelerates rapid prototyping of collection ideas. Each use case includes measurable metrics–CTR, conversion rate, and return on ad spend–to guide decisions and avoid waste.

Staying ahead means combining these use cases with clear governance: monitor model drift, protect customer privacy in emails and on-site interactions, and review results weekly. This approach keeps the experience unique, interactive, and profitable, empowering you to grow without sacrificing profits or brand tone.

Predictive Demand Forecasting for Replenishment

Recommendation: Deploy a 12-week replenishment forecast at SKU level, using a hybrid model that blends seasonality-based time series with ML signals from promotions, campaigns, and imagery-driven trend cues. Connect the forecast to an automated replenishment workflow that adjusts reorder points and safety stock weekly, reducing overstocking and stockouts while aligning with actual demand much more tightly.

Data inputs span sectors such as apparel, footwear, and accessories. Pull historical daily sales by SKU, promotions calendar, price changes, returns, on-hand by warehouse, and lead times. Add signals from imagery-related trends (color palettes, textures) and engagement metrics from marketing campaigns to capture shifts that static history misses. Sometimes these signals precede a measurable lift in demand, helping teams respond faster and reduce misalignment.

Model design blends a baseline forecast from seasonal time-series (Prophet or TBATS) with a lightweight ML layer that analyzes features like promotion intensity, discount depth, weather proxies, and event-driven effects. The output is a weekly forecast by SKU, plus lead-time demand and variability to feed reorder points and safety stock. Reorder point = LT demand + z * sigma_LT; choose z for service level targets (92–98% by category). For example, a fashion item with a 6-week lead time and 1,000 units monthly demand yields LT demand ≈ 1,500 units; if sigma_LT ≈ 350, safety stock ≈ 1.96 * 350 ≈ 686 units; ROP ≈ 2,186 units. Over a quarter, forecast accuracy (MAPE) improves from 14% to 6–12% for core SKUs, while low-velocity items see smaller gains.

Operational workflow: run weekly reviews with merchandising and supply chain, updating forecasts with business context such as new campaigns or store openings. Use interactive dashboards to highlight top SKUs, colorways, and sectors, and employ prompts to suggest actions when stock levels breach thresholds. This approach reduces thinking time and keeps decisions data-driven; maintain practical communications that prompt adjustments balancing customer demand with store capacity, rather than chasing noise.

Key metrics to track: forecast accuracy (MAPE), stock-out rate, overstocking costs, inventory turnover, and gross-margin impact. Compare uplift against a baseline quarterly, and do monthly backtests to ensure the model remains aligned with demand. The goal is to deliver a one-of-a-kind assortment that maintains high engagement with customers while avoiding overstocking and markdowns.

Risks and safeguards: avoid reliance on synthetic imagery signals or deepfakes for demand signals; verify data provenance and protect against data leakage. Keep humans in the loop for high-variance categories; adjust thresholds to prevent overreaction to short spikes. Maintain a thorough data-cleaning routine and monitor drift across channels and seasons.

Implementation tips: start with two pilots in different fashion sectors, then scale. Ensure data quality, integrate with ERP or replenishment modules, and establish a weekly ritual for reviews. Train planners on prompts to adjust buys and create a compact playbook, keeping the language clear and friendly to support engagement with non-technical teams.

Automated Store-Level Replenishment Across Channels

Should implement an AI-driven, cross-channel replenishment engine that autonomously triggers store-level orders daily, using real-time POS, e-commerce signals, and returns data to balance demand and supply across stores, DCs, and suppliers. The approach builds on a single auditable playbook with clear policies that give teeth to automation–automatic stock transfers, substitutions, and supplier confirmations when thresholds are met–and yields something actionable for field teams. The design reflects dynamic market conditions and rising demand in key sectors, driving intelligent decisions across channels.

Data foundation is the backbone of reliable outcomes. Build a unified data layer that combines store POS, online orders, mobile app activity, and returns, all at the SKU-store level. Ensure latency is low enough to capture shifts within an hour after a promotion or weather event. Tag items with attributes such as seasonality, format, and local events to improve demand sensitivity. Establish governance and data quality checks so that extracts of signals do not introduce noise into the models. In practice, visibility across hundreds of stores should feel like cars moving through a city: each vehicle (SKU) follows its lane, but the system can reroute flows in real time to avoid bottlenecks.

Developments in AI and policy design drive the action. Implement intelligent demand forecasting at SKU-store granularity using ensemble models that blend machine learning with rule-based adjustments for promotions, holidays, and store-specific temperament. One core goal: extract signals from internal and external sources–weather, traffic, local events, and promotional calendars–to sharpen accuracy. Pair the forecast with inventory optimization that computes target stock levels, minimums, maximums, and dynamic reorder points by store and channel. Establish cross-channel replenishment rules that move stock where it’s needed, including reverse replenishment to correct misallocations. Keep the policy grounded in sustainability: prioritize high-velocity items, minimize waste, and reduce markdown risk by aligning receipts with proven demand.

Actionable outputs guide daily operations. Create a per-store replenishment plan that includes recommended order quantities, transfer suggestions, and substitutions for fast movers. Build automated transfer queues with service expectations and escalation paths for exceptions. Enable supplier confirmations and purchase orders for critical SKUs, with fallbacks if supplier lead times increase. Provide store managers and replenishment teams with clear, prioritized actions and a simple way to approve or override when values fall outside expected ranges. Track performance by sector and by individual store to reveal pockets where climbing demand or rising stockouts require targeted adjustments.

Implementation should be pragmatic and measurable. Start with a 12-week pilot across 3-5 districts to validate data pipelines, model behavior, and policy efficacy, then scale to additional sectors. Target a forecast accuracy band in the 85-92% range for discrete items at the store level within the first three months, with continuous improvement as models learn. Expect fill rates in core categories to rise to the 95-98% band and stock turns to improve by 10-20% within six months, provided promotions and price changes are harmonized with replenishment rules. Monitor sustainability metrics closely: reduce waste, lower markdown exposure, and minimize obsolete stock through smarter safety-stock strategies.

Operational design emphasizes resilience and human collaboration. Ensure synchronization across sectors and channels so automated prompts do not conflict, and maintain a single truth source for on-hand and in-transit stock. Build guardrails for data privacy, supplier confidentiality, and regulatory compliance while keeping decision cycles rapid. Plan for reverse replenishment as a normal control path to correct misallocations without waiting for long lead times. Prepare for external disruptions–logistics delays or weather-related spikes–by maintaining recommended buffers for essential categories and critical items.

What success looks like in practice:

- Forecast accuracy by SKU-store is consistently within the 85-92% range; investigate systematic gaps by category and adjust input signals or model configurations accordingly.

- Channel fill rate stabilizes between 95-98% for core SKUs; stockouts drop below 2% in high-priority segments, driven by proactive transfers and substitutions.

- Inventory turnover improves, with a 10-20% lift achieved within the first year as receipts align with real demand and overstock is reduced.

- Transfer cadence becomes predictable: transfer lead times stay within agreed SLAs, and reverse flows effectively redistribute surplus without delaying receipts.

- Sustainability gains materialize as waste and obsolescence decline, aided by tighter safety-stock bands and smarter expiration-risk management.

Key considerations to maintain momentum:

- Keep the playbook dynamic. Regularly review policy thresholds, reorder logic, and transfer rules to reflect changing mix, promotions, and store performance.

- Center individuals in the workflow. Design role-based dashboards that empower store teams, district planners, and merchants to act on actionable insights without being overwhelmed by data.

- Embed risk flags into the system. When forecasts diverge beyond a defined tolerance, automatically route for human review and rapid remediation.

- Balance speed with scrutiny. Automation should accelerate decision cycles while preserving auditable trails and justification for each action.

- Connect with supplier operations for end-to-end efficiency. Transparent lead times, collaborative planning, and real-time confirmations shrink replenishment friction and improve overall reliability.

AI-Driven Markdown and Promotion Optimization

Recommendation: Build an AI-driven Markdown engine that ingests product briefs and outputs publish-ready promo blocks in Markdown and snippet-ready HTML, enabling rapid deployment across channels while minimizing manual edits.

Utilizing a node-based pipeline, separate data, templates, and copy variants. Create a feature bank of micro-prompts that adjust tone from subtle to bold, mirroring the brand face across campaigns; outputs should respect channel constraints such as product pages, emails, social posts, and home design displays.

Keep a granular attribute set: category, price tier, launch window, and environmental signals (eco-friendly materials, packaging). Generate multiple Markdown blocks with subtle variations for testing; after each run, extract takeaways showing which copy variants delivered the best engagement and which tone resonated with specific audience segments.

In practice, a benchmark from warby showed an 18-22% lift in CTR and a 40% faster turn-around when Markdown blocks were tuned by tone and audience signals. Mirror this approach with a baseline of 2-3 variants per asset and scale up to 6-8 for priority campaigns.

To start, assemble a compact template library and connect it to your product data feed. Use Markdown blocks to render consistent assets across home pages, email campaigns, and social posts, then feed results back into the system to refine the feature set. Takeaways from each run should include which tone performed best, which product attributes drove engagement, and how design choices matched the brand style.

Real-Time Omnichannel Inventory Visibility and Stock Accuracy

Implement a unified inventory platform with real-time data feeds and API integrations to synchronize stock across online store, mobile app, and brick-and-mortar locations within minutes. prada and others rely on live visibility to minimize stockouts and avoid overstocks, keeping space in stores and on shelves efficient. This approach comes with a single source of truth that streamlines decisions across teams.

To achieve 99% stock accuracy, run weekly cycle counts, daily reconciliations, and automated validations across online, app, and stores. This method reduces discrepancies by up to 40% in the first quarter and lowers backorders by 20-30% over six months. Discrepancies shrink, with counts being aligned to actual physical stock.

Live visibility raises engagement with customers, allowing more buying opportunities, increasing trust, and much selling across channels. Audiences see exact availability, which stops abandonment and improves conversion, especially during flash promotions and new releases.

Healthy data quality drives better demand forecasting, enabling the system to reallocate stock across styles created by designers. This reshaping of supply raises margins, reduces markdowns, and optimizes space, avoiding unnecessary holds while ensuring popular styles are always available.

Each item’s characters – color, size, and style – stay synced as live data flows through ERP, POS, ecommerce, and WMS. Maintain a friendly tone in customer-facing availability messages, offering real-time restock alerts to keep audiences engaged and the experience engaging.

Set a quarterly contest: reach 99% accuracy and 95% order fill rate across channels, then publish the results to motivate teams and share learnings with suppliers and stores. The transparency raises accountability and creates a culture of continuous improvement. Then track outcomes and publish learnings for the next cycle.

| Channel | Real-Time Visibility Benefit | Key Actions |

|---|---|---|

| Online | Shows exact stock on product pages, preventing selling items that are out of stock | Enable live sync with marketplace feeds; implement stock blocking when threshold reached |

| In-Store | Backroom and shelf counts synchronized to POS and back-office | Scan-based updates; cycle counts; automated alerts |

| Mobile/App | Customers see live availability and ETA for restocks | Push restock alerts; allow reservations for in-store pickup |

| Fulfillment | Optimized allocation across warehouses and stores | Auto-reallocation rules; cross-docking |

AI-Powered Loss Prevention and Stock Anomaly Detection

Start with an ai-powered, two-layer detection pipeline that uses neural time-series models to produce forecasts of demand drift and flag stock anomalies before losses occur. Connect POS, warehouse inventory, shipments, returns, and supplier data to a single source of truth, including the data source realreal, and apply fact-checking by auditors to confirm anomalies.

Layer 1 captures fast signals from live channels–POS feeds, shelf sensors, and audio cues from stores–that trigger lightweight alerts when deviations cross dynamic thresholds. Layer 2 runs heavier models on historical data to validate signals, suppress exaggerated alerts, and generate actionable recommendations for replenishment or stop-ship actions. This reverse validation keeps reality aligned with forecasts and reduces noise.

Implementation steps

Create a playbook with four scenarios: unexpected surge, mislabeling, supplier delay, and return flood. Each scenario includes steps: confirm with fact-checking, reverse any erroneous flag, adjust reordering rules, and log outcomes to the history for ongoing learning. Beginning with a clear creation process helps maintain consistency across stores and regions and extends reach as the program scales.

Maintaining data lineage matters; maintaining a clear lineage and enabling fact-checking against source data to ensure forecasts reflect reality. This system allows teams to act quickly, guiding replenishment and protecting profits, and providing a reliable playbook for teams. This approach increases profits by reducing stockouts and overstocks.

Top 10 AI in Fashion Use Case Examples">

Top 10 AI in Fashion Use Case Examples">